The Ultimate Guide To Pvm Accounting

The Ultimate Guide To Pvm Accounting

Blog Article

See This Report about Pvm Accounting

Table of ContentsEverything about Pvm AccountingSome Of Pvm AccountingThe Ultimate Guide To Pvm AccountingThings about Pvm AccountingIndicators on Pvm Accounting You Should KnowHow Pvm Accounting can Save You Time, Stress, and Money.How Pvm Accounting can Save You Time, Stress, and Money.

In regards to a company's total method, the CFO is accountable for assisting the company to satisfy financial objectives. A few of these techniques can entail the business being gotten or purchases moving forward. $133,448 annually or $64.16 per hour. $20m+ in yearly earnings Specialists have progressing needs for workplace supervisors, controllers, bookkeepers and CFOs.

As an organization grows, accountants can liberate extra team for other organization duties. This can ultimately cause enhanced oversight, higher precision, and much better conformity. With even more resources following the route of cash, a service provider is far more likely to earn money precisely and in a timely manner. As a building and construction firm grows, it will require the aid of a permanent economic staff that's handled by a controller or a CFO to handle the company's financial resources.

Our Pvm Accounting Statements

While huge organizations may have full time economic support teams, small-to-mid-sized businesses can employ part-time accountants, accountants, or monetary advisors as needed. Was this article useful?

Effective accounting techniques can make a significant distinction in the success and growth of building business. By executing these techniques, construction businesses can improve their financial security, improve procedures, and make informed decisions.

In-depth estimates and spending plans are the foundation of building and construction project management. They aid guide the task in the direction of timely and rewarding completion while safeguarding the rate of interests of all stakeholders involved. The key inputs for job cost evaluation and budget are labor, products, devices, and overhead expenditures. This is usually among the largest expenses in building tasks.

The Pvm Accounting Ideas

An accurate evaluation of materials required for a task will certainly help ensure the needed products are purchased in a timely way and in the appropriate quantity. A misstep below can bring about wastefulness or hold-ups due to product shortage. For most construction jobs, equipment is required, whether it is acquired or rented out.

Correct devices evaluation will certainly aid make certain the right devices is offered at the correct time, saving money and time. Do not fail to remember to make up overhead expenditures when estimating project expenses. Direct overhead costs specify to a task and might consist of temporary rentals, utilities, secure fencing, and water materials. Indirect overhead expenses are day-to-day costs of running your service, such as lease, management incomes, utilities, taxes, devaluation, and advertising and marketing.

Another aspect that plays into whether a task achieves success is a precise quote of when the job will certainly be finished and the relevant timeline. This quote helps make certain that a project can be ended up within the designated time and resources. Without it, a task might run out of funds before completion, causing possible job stoppages or desertion.

The smart Trick of Pvm Accounting That Nobody is Talking About

Accurate task setting you back can assist you do the following: Comprehend the productivity (or do not have thereof) of each job. As task costing breaks down each input right into a job, you can track earnings separately.

By recognizing these things while the task is being finished, you stay clear of shocks at the end of the project and can attend to (and with any luck stay clear of) them in future projects. A WIP schedule can be finished monthly, quarterly, semi-annually, or each year, and consists of task data such as agreement worth, sets you back sustained to date, overall estimated prices, and complete job invoicings.

Not known Facts About Pvm Accounting

It likewise offers a clear audit path, which is crucial for economic audits. construction taxes and compliance checks. Budgeting and Projecting Tools Advanced software application offers budgeting and projecting abilities, enabling construction firms to prepare future jobs more accurately and handle their financial resources proactively. File Monitoring Building and construction jobs involve a great deal of documentation.

Boosted Vendor and Subcontractor Monitoring The software can track and handle settlements to vendors and subcontractors, guaranteeing prompt payments and keeping excellent connections. Tax Obligation Preparation and Declaring Accounting software application can aid in tax obligation preparation and declaring, making certain that all pertinent financial tasks are properly reported and taxes are filed promptly.

All About Pvm Accounting

Our client is a growing advancement and construction company with headquarters in Denver, Colorado. With numerous active building jobs in Colorado, we are trying to find a Bookkeeping Aide to join our team. We official source are seeking a permanent Accountancy Assistant who will certainly be in charge of supplying functional support to the Controller.

Receive and assess everyday invoices, subcontracts, adjustment orders, acquisition orders, inspect demands, and/or other related paperwork for completeness and compliance with economic policies, procedures, budget plan, and legal needs. Update month-to-month evaluation and prepares budget trend reports for building jobs.

The Pvm Accounting Statements

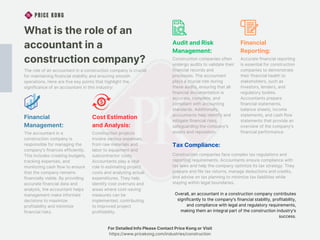

In this guide, we'll explore different elements of building accountancy, its value, the requirement devices made use of in this field, and its role in building and construction projects - https://pastebin.com/u/pvmaccount1ng. From economic control and expense estimating to capital administration, discover just how accounting can benefit building jobs of all ranges. Building accountancy describes the customized system and procedures used to track financial details and make calculated choices for building and construction companies

Report this page